Welcome Back

Sign in to be closer to your community!

Follow other divas, like and comment

on their posts, message them, and see

who loved your posts!

Invalid username or password

You have not verified your account by clicking on the link we sent you via email. Please check your email folders (including your Spam folder) and click on the verify link sent.

Email is required

Password is required

Join FashionPotluck.com

Create your own profile in order to create content, follow other divas and like their posts, use our own messenger, and be a part of a growing international women community!

WELCOME TO OUR COMMUNITY

Fashion Potluck -

the first social media

platform for women.

You are free to read/watch & create content,

express your true self, and interact with others.

Join for free

Already a member? Log in here.

Purchase Alert

Dear Queen, you can only buy from one seller at the time. Please finish this purchase first in order to buy from another FP member

Comments

Please select one platform to continue

Please select one platform to continue

Please select one platform to continue

Please select one platform to continue

Please select one platform to continue

Please select one platform to continue

Please select one platform to continue

Please select one platform to continue

EDITOR APPROVED

You are wondering what is this 'Editor Approved'?

Well, this is pretty awesome! In order for the post to qualify and receive this accolade, it has to have a minimum of 700 words and two images (at least one original).

Receiving this accolade means two things: 1) Your content is amazing! Good job! 2) Your content qualifies for our monetization program. Every week two of the most read posts receive monetary rewards.

Have the badge & want to monetize your content?

LIFESTYLE

Revolut has been on the market for a few years now and it made a name for itself due to the appeal it has for younger generations. I’ve been a proud owner of an account and card for a couple of years now and I want to highlight a couple of benefits that you can get if you decide to join.

1. Best exchange rates

This was the main reason I wanted the card in the first place. Since I do like to travel A LOT I know it’s important to get a decent exchange rate.

The way I use it is I add money from my main account and then I do the exchange in the currency I know I might need during the week. It’s known that during the weekend, the rates might be bigger so I do my best to think in advance.

If I am in a country where I know I might need cash, I just find an ATM that is from a big bank (careful at Euronet ATMs these have huge fees) and I withdraw in the local currency.

Since I live in a country with its own currency, I use Revolut a lot when I am paying for orders that are from outside my country. This way I avoid having to pay a larger amount just because of the conversion rate that my bank will have.

2. Having a second card for security reasons

If you only have one card and you use it for everything, including savings and have your main income on it, you might be at a huge risk of having it cloned or hacked.

We live in some very dark times, and cyber security has been on the rise for a while now, keep your money safe by always having 2 cards.

The main card where you receive money or you keep larger amounts, should only be used as a proxy card. Do NOT save it in any applications and make sure you have multi factor authentication always on.

Make sure to withdraw money only from very safe ATMs or from the bank that emitted the card.

Furthermore, if you have the option, make sure you receive a message from your bank each time money is added or withdrawn from your account.

You need to have a second card for all the other payments. It doesn't have to be Revolut, but you need another account from where you can add only a limited value and from where you can spend for online shopping and even for cash withdrawal from street ATMs or when you are traveling.

The second card is also the one you should save in your phone, add to Apple / Google Pay or use for online or in store purchases. Even if the worst is to happen and you get your card cloned and money withdrawn, at least it’s not going to be a huge amount (never keep large amounts on your day to day card) or you can have it blocked in a few seconds from the app.

3. Virtual cards

There might be vendors that you know will be risky, maybe with locations in foreign countries or new vendors that you’ve never tried before. For this type of transaction, I recommend the virtual cards that can be created from the Revolut app.

The cards are available for the free account as well as for the premium ones. You can create as many as you would like and you can discard them after using them, or just freeze them.

This way you know that the only money that will go out is the one you authorized the first time. Your account is safe and you do not have to worry about it again.

4. Extra security checks

Revolut has a few extra security checks that you can enable, one of them is location-based payment. In case someone from a different location than yours tries to make a payment using your card, it will be declined since the app will know that you are not at that location.

I had a bit of a scare when I saw that someone was trying to make a payment from Madrid, while I was home. It was only 1 euro and it got blocked by Revolut instantly.

5. Send money and receive it instantly

If I need to send money or receive money from peers, using Revolut is the easiest way. All they need is to search my number or my id and then we can send any amount in a few seconds.

It comes very handily when we go out and we can pay with one card and then split the check and transfer the money to whoever paid in full.

You can also use the split bill functionality where everyone will receive a request to pay their share.

6. Saving and financial planning

Since I am doing my best to keep an eye on my budget, creating weekly amounts and only adding those to Revolut has helped me save. I have easy access to the information and I know when I am out of budget.

Furthermore, Revolut has an option to round up spare change in a vault. You can save for something that you might one just from using the card and having the spare saved in a different place.

Currently, I have 2 vaults where I save the spare change (x2) and I plan on using them for travel expenses or perhaps a nice present for myself.

7. Investing in stocks and crypto

I am not an expert on the matter, therefore I would present the option with the disclaimer that it’s not a risk-free type of investment and you should consider learning about it before jumping into it.

For me it was the first connection I had with the investments area and back in 2020 I bought a few stocks, in a year’s time some of them doubled in value, others decreased. It was nice to play around with it and see what that is all about.

Cannot say that I plan on using Revolut for stock investments all my life, but I do consider it a nice place to start if that is something that you have on your plan.

8. Other cool features

Revolut has a huge amount of features, yet I will mention only the ones I frequently use.

Rewards programs are pretty nice since you get to have discounts or cash back at different vendors.

Create multiple currency accounts that you can fund or exchange money in. At the moment I have around 4 that I am frequently using, but you have almost all the currency of the world.

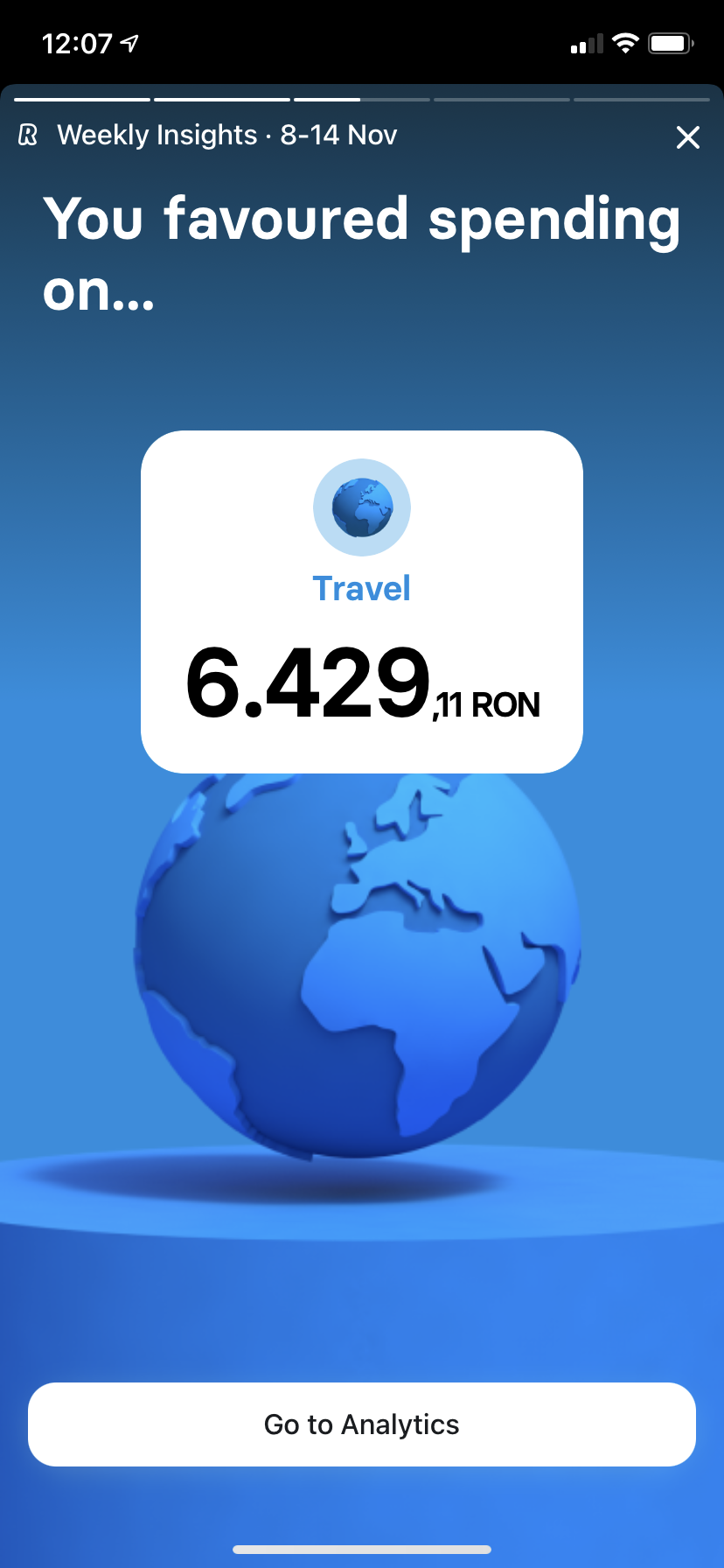

Weekly overview of what you’ve spent money on and your top buys.

Travel insurance is another great option to use if you do not want to deal with a broker. Everything is done through the app and in a couple of minutes you are all set.

Chatting with Revolut is another big thing, in 2 minutes you can chat with someone from support in case you run into any issues. I did it twice and their support service is great, I got my issue solved instantly.

You are interested in joining Revolut you can signup using the link below: https://revolut.com/referral/iulianccc!NOV2AR

Xoxo,

Iuliana

Comments

Related Posts

- How to Take Care of Your Freshly Made Veneers by Monica Quinn 0

- AI Agents in Customer Support: Moving Beyond Chatbots by Ella Taylor 0

- What to Expect From a Consultation With an Immigrant Attorney? by Monica Quinn 0

More Posts

- Sri Lanka vs Afghanistan 2026 T20 Series: Asian Cricket Showdown in Colombo by Taniya singh 0

- IPL2025: How Cricket's Digital Future Is Being Redefined by the Indian Premier League by Diksha Chaurasiya 0

- Lost and Found: Turning Global Exploration into Store Management Strategy with GeoGuessr Free by 0

Vote content out

Reason for voting this content out?

Reason for voting this content out?

Login with Google

Login with Google Login with Twitter

Login with Twitter

by

by

Add Comments